For Instant Free Demat Account Call : +91 9559411441

Email : info@smartmoneygrow.com

Our FM Nirmala Sitharaman presented the longest-ever budget in India’s history, this Saturday. From a new tax plan to boost infrastructure expenditure to a 16 point plan for Agri, the government tried to revive the declining growth rate, even estimated nominal growth rate to be at 10 perc in GDP.

Leaders from opposition parties are describing this budget as ‘hollow’ but PM Modi welcomed it for its ‘vision and action’. Having said that, let’s have a look at key takeaways from Budget 2020-21:

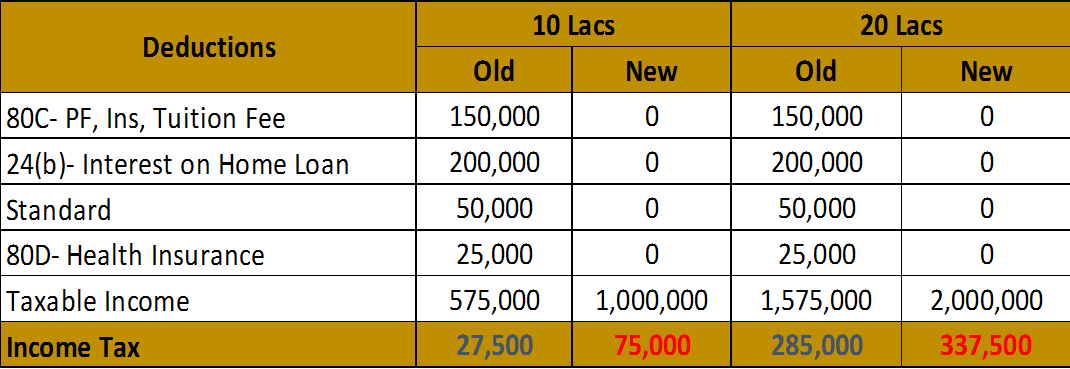

Now, let’s compare the old tax plan with a new tax regime at 2 income slabs of 10L& 20L p.a through a table below-

Though a new tax plan offers lower income tax rates it excludes deductions means the only way to save tax with the new plan is to not save anything and don’t have any home loan. I have rarely come across a person waging 10-20 lacs a year with no investments, no insurance, and no home loan. So it’s a bane for me.

Navigating the intricate landscape of government policies and economic strategies is akin to playing a strategic game at an online casino craps table. Just as individual taxpayers weigh the pros and cons of their financial decisions, investors too find themselves at the crossroads, pondering whether the current economic landscape is a boon or a bane.

While the government unveils ambitious plans such as the 16-Point action plan to revive agricultural growth, the manufacturing sector receives a mixed bag, with only a 6K Crore allocation to the BharatNet program and the defense sector seeing a lower-than-expected allocation. In this high-stakes game of economic resurgence, every move counts, much like the calculated rolls of the dice in an online casino craps game. For those unfamiliar, casino craps is a thrilling dice game where players strategically place bets on the outcome of the dice rolls, adding an element of chance and excitement to the economic game of life.

smartmoneygrow.com © 2020 | All Rights Reserved